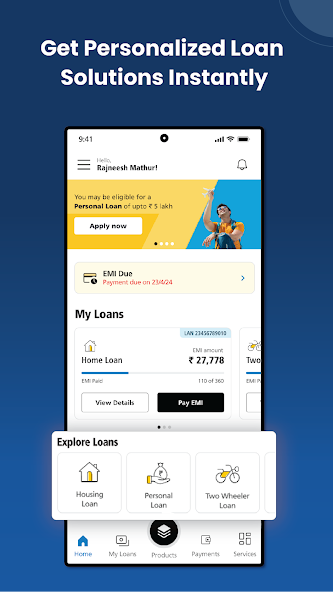

Managing sudden financial needs can be challenging. Whether it’s a medical emergency, home repairs, or unplanned travel, immediate access to funds is often crucial. This is where applying for a personal loan online becomes highly convenient. With minimal paperwork and faster approvals, you can secure a quick loan within minutes. The digital lending landscape has simplified the borrowing process, making it easy for anyone with a steady income to access credit without visiting a physical bank or standing in long queues.

This explains how to apply for an instant personal loan online, the process involved, eligibility, and tips to ensure your application is approved swiftly.

What is an Instant Personal Loan Online?

An instant personal loan is an unsecured form of credit offered digitally. The entire application process—from submission to disbursal—takes place online. Since it’s unsecured, you do not need to pledge any collateral, which makes it ideal for salaried professionals, freelancers, and self-employed individuals.

Online personal loans offer flexibility in usage. You can use the funds for medical bills, education, rent deposits, travel expenses, or even consolidating previous debts. The biggest advantage lies in the quick loan approval and disbursement mechanism.

Eligibility Criteria for Personal Loan Online

Before applying, it’s important to understand the basic eligibility requirements. Although the criteria can differ slightly, most online platforms follow these general parameters:

- Age: Usually between 21 to 58 years

- Employment Type: Salaried or self-employed

- Minimum Income: Varies by location and lender; a stable income source is a must

- Credit Score: A healthy credit score improves your chances but isn’t always mandatory

- Bank Account: Must have an active savings account for disbursal

Being aware of these basic conditions helps speed up your application and reduces the chances of rejection.

Steps to Apply for an Instant Personal Loan Online

Applying for a personal loan online is a straightforward process. Here are the typical steps:

Step 1: Choose the Loan Amount and Tenure

Select the loan amount you require and your preferred repayment duration. Online calculators are often provided to help you determine a suitable EMI based on your income.

Step 2: Fill Out the Application Form

Enter your basic details such as name, date of birth, mobile number, employment type, income details, and required loan amount. This is the primary screening step.

Step 3: Upload Required Documents

Most applications require minimal documentation, such as:

- Identity Proof (Aadhaar card, PAN card, etc.)

- Address Proof

- Income Proof (salary slips or bank statements)

- Employment Proof

These can be uploaded directly to the platform.

Step 4: Verification and Approval

Once you submit the form and documents, a digital verification process begins. If all details are in order, approval is usually granted within minutes.

Step 5: Loan Disbursal

After approval, the sanctioned loan amount is credited to your bank account, often within the same day or even a few hours.

Benefits of Getting a Personal Loan Online

Fast Processing

The biggest benefit of applying online is the speed. From document upload to verification and disbursal, everything happens much faster compared to traditional methods.

No Collateral Required

As an unsecured loan, you don’t need to mortgage any property or assets, making the loan accessible to a broader range of borrowers.

Paperless Process

The entire journey—from application to approval—is digital, minimizing paperwork and physical interaction.

Flexible Repayment

Borrowers can choose the repayment tenure that suits them best, generally ranging from 6 to 60 months.

24/7 Accessibility

Applications can be made anytime from anywhere, making it especially useful during emergencies.

Tips to Improve Instant Loan Approval Chances

- Maintain a Healthy Credit Score: Although not always mandatory, a good credit score reflects your creditworthiness.

- Accurate Information: Double-check all personal and income-related data you provide. Even small errors can lead to delays.

- Submit Clear Documents: Ensure all uploads are legible, valid, and current.

- Avoid Multiple Applications: Applying to too many platforms simultaneously can reduce your credit score and delay approvals.

Things to Keep in Mind Before Applying

Loan Charges

Always check the processing fee, late payment penalties, pre-closure charges, and interest rates. Understanding the full cost helps avoid future financial stress.

Loan Tenure

Choose a repayment period that aligns with your monthly income and existing financial obligations. Shorter tenure means higher EMI but lower overall interest, while longer tenures ease monthly burden but increase interest cost.

Repayment Discipline

Missing payments can hurt your credit score and attract penalties. Set up automatic deductions or reminders to stay on track.

Conclusion

A personal loan online can be a useful solution during financial crunches, offering quick access to funds without extensive paperwork or collateral. With most approvals and disbursals taking place in just a few minutes, borrowers today enjoy unparalleled convenience. However, it’s essential to borrow responsibly and only take a quick loan when truly needed.

By understanding the process, eligibility, and best practices, you can improve your chances of getting approved instantly. Make sure to compare options, read the terms carefully, and repay the loan on time to maintain your financial health.

So the next time you find yourself in need of urgent funds, remember—you can get an instant personal loan online in minutes, right from the comfort of your home.