Personal loans are always changing due to shifting customer tastes, technological improvements, and changes in the financial sector. As we move towards the future, a number of trends and innovations are reshaping borrowing and altering how people access credit. In this blog, we’ll look at how personal loans will develop in the future while emphasizing the trends and technologies that are on the verge of revolutionizing the borrowing industry.

- Complete digitization

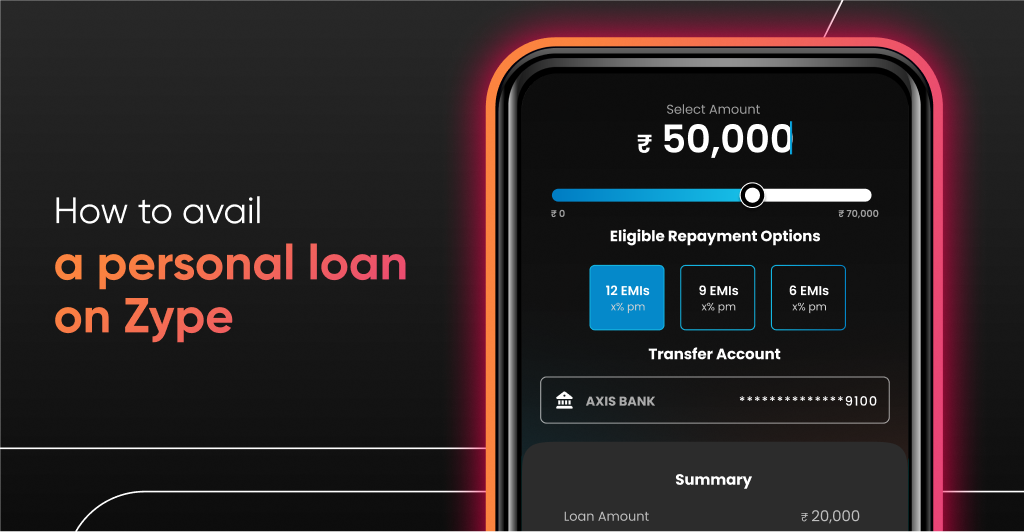

Before, you had to visit the bank repeatedly in the hopes that your loan application would be granted. Nowadays, everyone owns a smartphone, and the fintech boom has made it simple to submit a personal loan application using a reliable loan app personal. The personal loan application process being digital has helped sales climb.

The arduous and time-consuming loan application process is a thing of the past. In this situation, you can submit an online personal loan application. Now, it’s also simple to compare the features of several loans, and the application process may be finished in a few minutes.

- Customized Products

As data machine learning and analytics skills advance, lenders will be able to provide more specialized loan solutions that are suited to the requirements of specific borrowers. With the help of an easy loan app, offerings for personalized loans take into account things like income, spending patterns, financial objectives, and risk tolerance. Lenders can offer more pertinent and advantageous borrowing choices by tailoring loan conditions to each borrower’s particular situation.

- Bigger competition, better products

Prior to now, the majority of banks and non-banking financial institutions would scrutinize your loan application in great detail. However, the situation has now altered with the emergence of a small loan app. The majority of applicants were turned down, and those who made the shortlist had to demonstrate their capacity to repay by offering further documentation as additional proof.

The situation has now altered. Banks and lenders are interested in improving their sales by expanding access to personal loans because of the increased competition in the market.

- Credit score awareness

For someone with little or no credit history, traditional credit scoring models that mainly rely on credit history can be a hurdle. However, the future of personal loans is evolving with the emergence of personal loan apps India. In order to evaluate creditworthiness, these techniques use non-traditional data sources like utility bill payments, rental history, and even social media activity. Alternative credit scoring enables lenders to assess the credit risk of a more varied pool of borrowers by taking into account a wider range of data.

- Better accessibility and availability

Being essential to consumer finance, personal loans’ business reach, and smooth touchpoints play a crucial role in the development of the market and in how they are conducted. Accessibility, or the degree of digital adoption (mobile phones, digital literacy, adoption), and availability. The variety of digital channels, devices, and platforms—including mobile phones, the web, and physical models—address these issues. Due to technology, borrowers now have access to credit every single day of the year.

Conclusion

Borrowers can anticipate a more inclusive, user-friendly, and effective borrowing procedure as the financial sector adopts these advances. With the introduction of cutting-edge technologies, the landscape of personal loans is expected to open up to a wider spectrum of people while also providing specialized solutions that address certain requirements and preferences.

In order to navigate the changing personal loan market and take full advantage of the opportunities that are presented in the borrowing future, it will be essential for borrowers to be educated about these trends and innovations.