Day by day, the Indian economy is booming. More investors are entering the capital market for various investment opportunities. Especially after the availability of demat online, the whole system became quite easier. So, the overall financial condition is changing rapidly around the economy. Even nowadays, parents are teaching financial skills like investment to their children.

To teach financial skills to the next generation, it is a better option to open a trading demat account. A Demat account is a prerequisite to start investment, even for minors like your children or teenagers. But you may be shocked that without a minimum of 18 years of age, how can one open a demat account? It is also possible to open a demat account for them. Individuals under 18 years of age are also able to own their demat account. Yes, you read it right.

Here are the comprehensive details of the demat account opening for minors.

Demat account for minors in India:

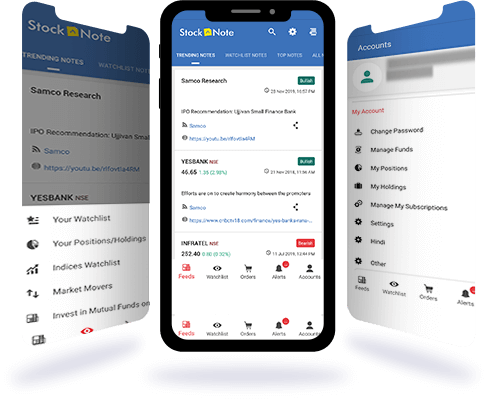

The Central Depository Services Limited and NSDl control all demat accounts in India. Previously, only adults could open their demat account through stock brokers. Now, anyone can open demat accounts through a demat account opening app. Even minors are also eligible to open their demat accounts through mobile apps or online sites.

Though there are some restrictions to opening a demat account for minors, they can also hold shares of publicly listed companies according to the Companies Law Act 2013. According to the law, minors are not able to buy or sell any kind of shares for themselves. They will have one guardian or parents. The court of India will decide the appointment of parents or guardians for the purpose of purchasing or selling any share. The documented owner will be the minor, but the guardian takes care of all kinds of work like opening demat accounts, closing, and managing accounts.

What are the documents required for opening minor demat accounts?

To open a demat account for minors, these below-mentioned documents are mandatory.

- Pan card details of guardian

- Birth certificate of the minor individual

- Identity proof and address proof

- Bank details like a bank account

The guardian should also submit their details KYC if required. Usually, any modern demat account app demands these documents to verify the identity.

What are the restrictions for minor demat account opening?

According to the legal rules, there are some restrictions for minor trading demat accounts as follows.

- There is no chance of opening a joint demat account while opening a minor demat account.

- All kinds of transactions are solely the responsibility of the guarding. The guardian is the authorized controller of the account.

- Intraday trading and currency trading are not allowed for minor demat accounts.

- Through a minor demat account, you can only buy and sell equity.

Benefits of minor demat account

Opening a minor demat account has a few benefits.

- Safe future: Opening a demat account means drafting the path of investment. It can build a safe future for the children. Over the long term, this small move will return huge rewards.

- Financial skill: When you will open a Demat account for your children, they will learn an overview of investment and financial skills. They will understand the importance of investment from a very early age. Slowly, they will ace the financial state.

Conclusion:

Investment is one of the best things for all to build a strong wealth for the upcoming days. From a very early age, it is a good practice to start learning about investment or other financial skills. A minor demat account is one such way to learn financial skills.