In today’s fast-paced world, financial needs can arise at any moment. Whether it’s an unexpected medical expense, a sudden car repair, or even a dream vacation, having access to quick and reliable funds has become more essential than ever. This is where the power of personal loan apps comes into play, revolutionising how we secure and manage our finances.

In this article, we’ll delve into the world of personal loan apps, their benefits, and how they are transforming the lending landscape.

The Rise of Personal Loan Apps:

Disappeared are the times of extended waitings at the financial institution, ample documentation, plus holding back weeks for loan confirmations. Personal loans applications have arisen as an energetic solution to these customary miseries. These applications have revolutionised the loan-acquiring procedure into an effortless digital involvement.

Convenience Redefined:

Unrivalled convenience is the key attraction of personal loan apps. The conventional loan procedures usually involve repeated trips to the bank and endless documentation. However, with loan apps, you can effortlessly accomplish the entire process from the cosiness of your residence or workplace. Bid farewell to wasted time in traffic or enduring lengthy queues. Acquiring funds with a few effortless touches empowers you to promptly attend to your financial requirements and focus on the genuine priorities in your life.

Flexible Repayment Options:

Personal loan apps understand that one size does not fit all regarding loan repayment. These apps empower you with a range of flexible repayment options. Whether you prefer to repay the loans lump sum or break it down into smaller instalments, the choice is yours. This flexibility ensures you can align your loan repayment with your financial circumstances, reducing the stress often accompanying traditional fixed repayment plans.

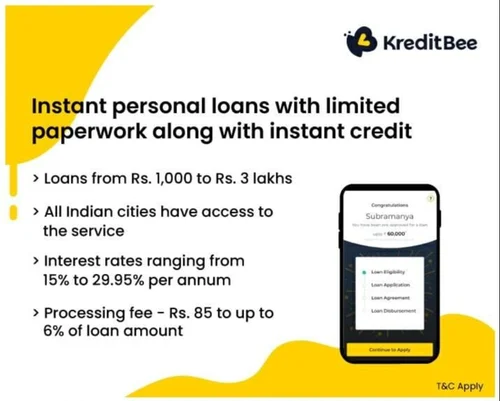

Competitive Interest Rates:

Financial well-being is closely tied to interest rates, and personal loan apps have taken note. These apps offer competitive interest rates that rival or even outshine traditional lenders. This means that not only are you getting the instant loan you need promptly, but you’re also doing so without breaking the bank in interest payments. It’s a win-win situation that reflects the modern borrower’s desire for affordable and transparent lending solutions.

Easing the Documentation Burden:

A significant concern when applying for a loan is the overwhelming amount of paperwork needed. Personal loan applications have taken a proactive approach to address this problem by decreasing the necessary documentation. Several applications utilise technology to authenticate your identity and financial details, lessening the requirement for numerous photocopies and paperwork.

Financial Empowerment:

In addition to the immediate advantages of obtaining funds, personal loan applications have a noteworthy impact on monetary liberation. These applications frequently offer informational materials and utilities that assist borrowers in making educated choices. From pointers on budgeting to comprehending credit ratings, these applications transform borrowers into financially astute individuals who are better prepared to handle their finances.

Final Thoughts:

Apart from the instant profits of acquiring funds, personal loan applications remarkably affect monetary freedom. These applications frequently provide informative resources and tools that aid borrowers in making informed decisions. From tips on managing finances to understanding credit scores, these applications transform borrowers into financially savvy individuals better equipped to manage their money.